Obtaining a Federal Tax Identification Number E-Daftar is a website that allows you to register online. OR b Certificate of incorporation of company.

How Is Taxable Income Calculated How To Calculate Tax Liability

Visit the Inland Revenue Board of Malaysias official website for further.

. As a taxpayer you must have an income tax number to pay taxes. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard.

Other income is taxed at a rate of 30. Search Result It will show No Record Found as shown if you do not have an income tax number If. Select the Form CP55D and complete the pdf form.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. When u submit your borang BE the IRD will open a file income tax number. Up to RM3000 for.

On the e-Verify Return page enter your PAN select. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay. Deadline for Malaysia Income Tax.

This unique number is known as Nombor ukai Pendapatan or Income Tax. Scroll to the bottom and click Next. Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia.

. RM9000 for individuals. Malaysia Information on Tax Identification.

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. The main source of personal income tax for expats in Thailand is through employment. Obtaining a Federal Tax Identification Number E-Daftar is a website that allows you to register online.

Tax rates range from 0 to 30. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification. Visit the Inland Revenue Board of Malaysias official website for further.

Kad Pengenalan Baru tanpa simbol - seperti format berikut. How can I check my income tax return online. Click on Application and then e-Filing PIN Number Application at the left menu.

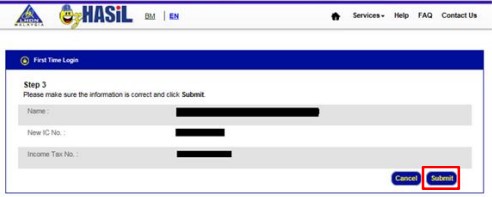

Fill in the Information Fill in the related information Then click Submit 3. Go to the e-Filing portal homepage and click e-Verify Return. A Private Limited Company b Limited Company.

Tax rates range from 0 to 30. E-Daftar is an application for new taxpayers to register their tax files and to get their tax reference no. Select Application from the left-hand menu then e-Filing PIN Number Application from the drop-down menu.

How to use your parents to claim higher income tax relief. A Notice of registration of company under section 15 Companies Act 2016. It takes just four steps to complete your income tax number registration.

If you were previously employed you may already have a tax number. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. E-Daftar Melayu Please Check Your Income Tax No.

Heres how to apply for your PIN number using the internet. Obtaining a Federal Tax Identification Number Visit the official website of the Inland Revenue Board of Malaysia. How do I get my income tax number Malaysia.

Taxable Income MYR Tax Rate. Fill in the blanks to receive your income tax number.

Notice Of Malaysia Implementation Of A New Registration Number Format For Business Entities Registered With Companies Commission Of Malaysia Ssm E Spin Grou Indirect Tax Tax Irs Taxes

Taxable Income Formula Examples How To Calculate Taxable Income

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Income Tax Number Registration Steps L Co

Malaysia Personal Income Tax Guide 2021 Ya 2020

Do You Need Weakly Or Monthly Payslips Or P60 Documents Payroll Template National Insurance Number Templates

The Complete Income Tax Guide 2022

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Personal Income Tax Guide 2021 Ya 2020

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

How To Do E Filing For Income Tax Return In Malaysia Just An Ordinary Girl Income Tax Return Income Tax Tax Return

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

.png)

How To Check Your Income Tax Number

How To File Your Taxes For The First Time

How To Calculate Foreigner S Income Tax In China China Admissions

How To File Your Taxes For The First Time

The Complete Personal Income Tax Guide 2014 Infographic Imoney

Can Nris Invest In Public Provident Fund Or Ppf Nri Banking And Saving Tips Public Provident Fund Investing Savings And Investment